“...economic growth is the supreme good, or at least a proxy for the supreme good, because justice, freedom and even happiness all depend on economic growth” (Sapiens, 351).

Grow or Die

That’s the situation we’re in.

That’s why we don’t have magnificent train stations, castles or public gardens in North America. It’s why innovative companies like SpaceX get so much government funding. It’s why getting government funding for projects without clear pathways for financial growth don’t get through.***

Most of the money in circulation today doesn’t really exist. As we spoke about previously (HERE), money is a system of trust. It used to be trust in biological value, then cultural value, then trust in the state, and now it’s combined with a trust in the future. Most money is credit.

What is Credit?

Credit is the difference between today’s economic output and future economic output.

Credit is borrowed money.

When we borrow money, we trade our future money for someone else’s current money. For example, you give me 5 today, I’’ll give you 5 tomorrow. I use their current 5, and trade my future 5.

However, usually there’s interest when borrowing money. That means I’m trading them more of my future money than their current money. So in the above example, I would pay back 6, 7 or even 8 dollars, instead of the same 5.

Why Would I do That?

I have a project I want to start that I believe will be super profitable. But to get it off the ground, I need a lot of money all at once. I don’t have enough money to start the project, but in the future, if I could start the project today, I will have more than enough to afford it.

Credit allows me to buy something today based on a mutual belief between myself and the lender that I will have the MORE money in the future.

This is how almost every project starts. That’s why banks are so big. Banks lend money at interest to individuals, to companies and even to governments. In fact, according to American Law, banks are allowed to have 10 dollars of credit lent our for every one dollar of cash in their reserves. That means up to 91% of the money in circulation in the United States rests entirely on our belief in the future.

That’s why capitalists believe growth is the supreme good. Because without it, what will happen to all the credit? If we stop believing that tomorrow’s economic pie will be bigger than today’s economic pie, then we’re in serious trouble.

We Need Scientists

On the other hand, if scientists continue making breakthroughs and creating new industries, and belief in the future becomes rock-solid, borrowing money will cost nothing and we can all be rich (kinda).

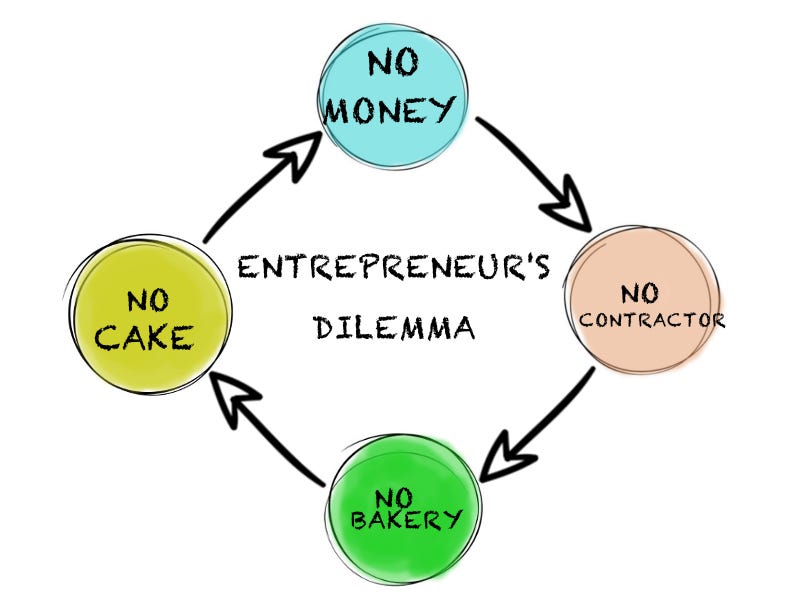

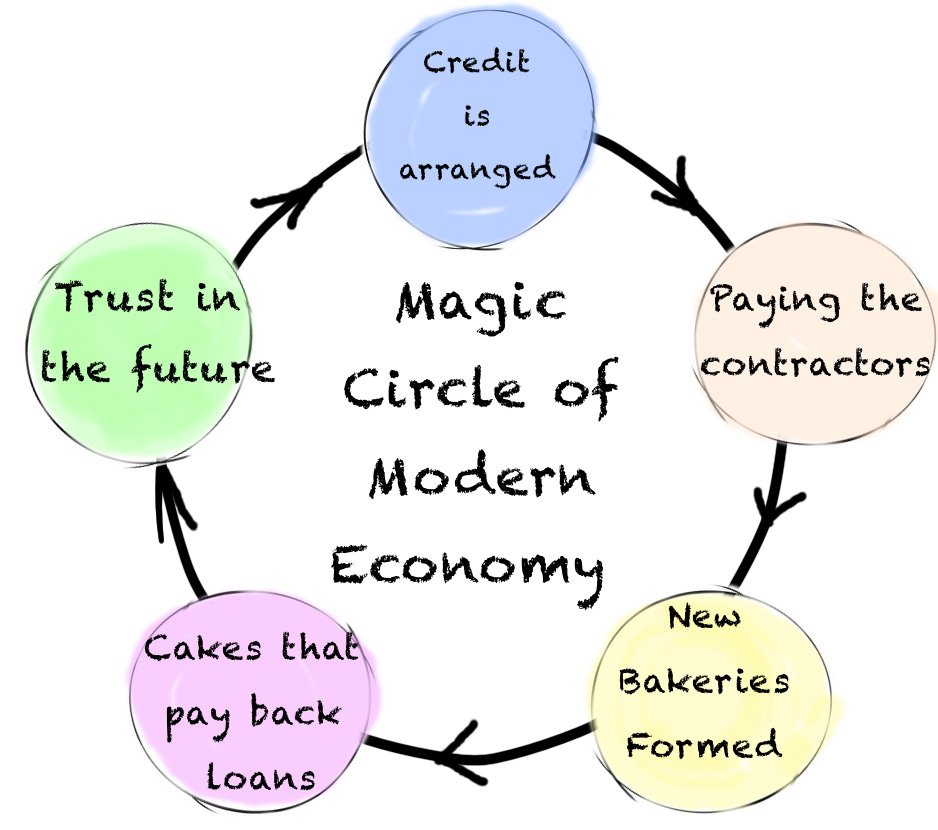

We need scientists to make discoveries. Then the discoveries become inventions. And the inventions get commercialized. But to fund the science, we need money. And that money needs trust in the future. That’s the story of the Entrepreneur’s Dilemma and the Magic Circle of The Modern Economy.

Takeaways

There are many takeaways here. Personally, I would recommend reading this chapter in its entirety. It’s worth it. But here are MY key takeaways

Scientists drive us forward. They are the most important people.

Like it or not, there’s no going back. With trillions in global debt, there’s no going back now.

Value of money is based on credit and credit is based on trust in the future.

Question of The Day

Do you trust the future will be better than the present?

Your Biggest Fan,

Noah “BigNerd” Sochaczevski